Crypto Cycle 2025: Next Major Bitcoin Bull Run Expected

Bitcoin’s cyclical nature has created distinct market patterns throughout its history. As we approach 2025, investors are closely watching for signs of the next major Bitcoin bull run. Historical data, expert analysis, and market indicators all point to 2025 as a pivotal year in the cryptocurrency market cycle. This comprehensive guide examines the factors driving the next potential surge and how investors can strategically position themselves.

Understanding Bitcoin’s Historical Market Cycles

Bitcoin’s major bull run cycles have followed a pattern roughly every four years

Bitcoin has demonstrated remarkable cyclical behavior since its inception. These cycles typically follow a pattern of accumulation, uptrend, euphoria, and correction. The most notable bull runs occurred in 2013, 2017, and 2021, each delivering exponential returns to investors who positioned themselves early.

The 2013 cycle saw Bitcoin rise from under $15 to over $1,100, representing a 7,300% increase. The 2017 bull run pushed Bitcoin from approximately $1,000 to nearly $20,000, a 1,900% gain. Most recently, the 2021 cycle drove prices from around $10,000 to $69,000, a 590% increase.

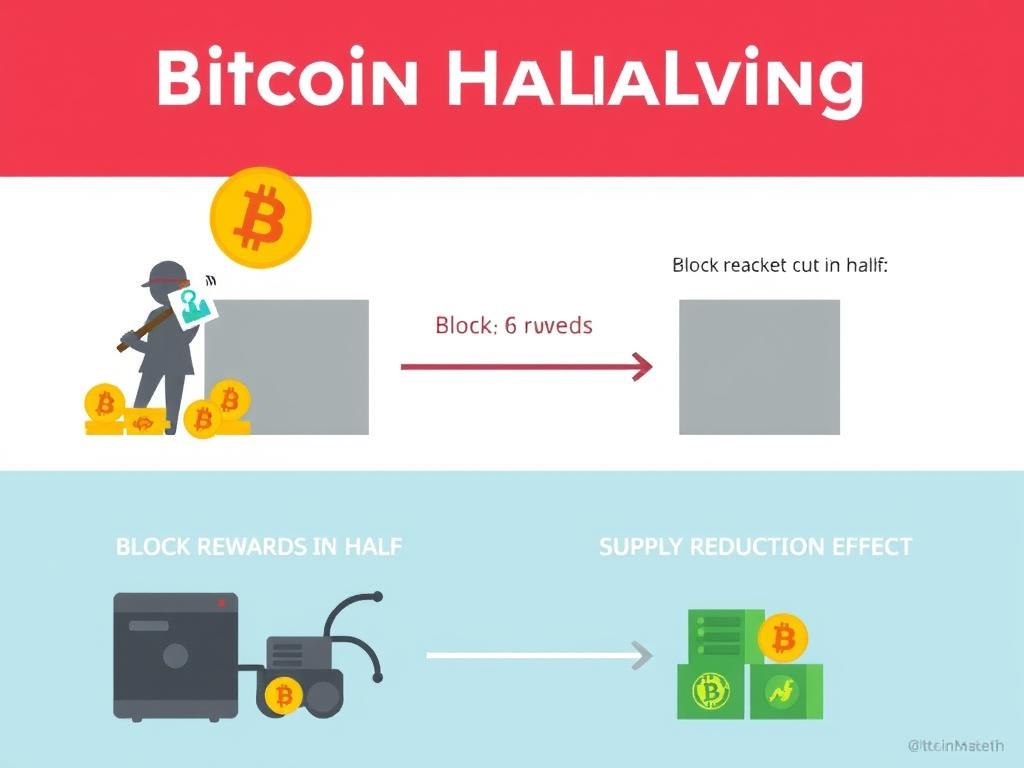

These cycles have historically correlated with Bitcoin’s halving events, which occur approximately every four years and reduce the rate at which new bitcoins are created. This programmed scarcity has been a fundamental driver of previous bull markets.

Analysis of Past Bitcoin Bull Runs and Their Triggers

The 2017 Bull Run

The 2017 bull run was characterized by unprecedented retail investor interest, fueled by mainstream media coverage and the emergence of initial coin offerings (ICOs). Key triggers included:

- The Bitcoin halving in July 2016, which reduced block rewards from 25 to 12.5 BTC

- Increased institutional interest and legitimacy

- Launch of Bitcoin futures on the Chicago Board Options Exchange (CBOE)

- Widespread media coverage creating retail FOMO (fear of missing out)

The 2021 Bull Run

The 2021 cycle demonstrated a shift toward institutional adoption. Major corporations and financial institutions began adding Bitcoin to their balance sheets. Key catalysts included:

- The May 2020 halving event, reducing block rewards to 6.25 BTC

- Institutional adoption led by MicroStrategy, Square, and Tesla

- Widespread inflation concerns following pandemic monetary policies

- Mainstream payment platforms like PayPal enabling cryptocurrency transactions

“Against popular belief, Bitcoin’s history shows that it likes to top on bullish narratives and bottom on bearish ones. This contrarian pattern has been consistent throughout multiple market cycles.”

Expert Predictions for the 2025 Bitcoin Bull Run

Industry experts have varying predictions about the timing and magnitude of the next Bitcoin bull run, but many point to 2025 as a pivotal year. Here’s what leading analysts are saying:

Price Predictions

Analysts from major financial institutions project Bitcoin could reach between $150,000 and $250,000 during the 2025 bull run. These projections are based on stock-to-flow models, adoption rates, and historical cycle analysis.

Timing Projections

Most experts anticipate the bull run to begin in early to mid-2025, approximately 12-18 months after the April 2024 halving event. This timeline aligns with historical post-halving price action patterns observed in previous cycles.

Market Cycle Duration

The consensus among technical analysts suggests the 2025 bull cycle may be more extended than previous ones, potentially lasting 12-18 months before reaching a peak. This extended timeframe reflects the maturing market and increased institutional participation.

“The 2025 Bitcoin bull run may be characterized by more institutional participation and less retail FOMO than previous cycles. This could result in a more sustained uptrend with lower volatility.”

Key Factors Driving the 2025 Bitcoin Bull Run

Several fundamental factors are converging to create favorable conditions for a significant Bitcoin price surge in 2025:

Bitcoin Halving Impact

The April 2024 Bitcoin halving reduced the block reward from 6.25 to 3.125 BTC. Historically, halvings create supply shocks that manifest in price increases 12-18 months later as the reduced supply meets growing demand.

Analysis of previous halving cycles shows that peak prices typically occur 12-18 months after the halving event, placing the potential peak of the next bull run in late 2025 or early 2026.

Institutional Adoption

Institutional adoption continues to accelerate, with more corporations adding Bitcoin to their balance sheets as an inflation hedge and portfolio diversifier. The approval of spot Bitcoin ETFs in the US has created an easier on-ramp for institutional capital.

According to Glassnode data, institutional holdings of Bitcoin have increased by over 40% since 2021, with projections suggesting this trend will accelerate through 2025.

Regulatory Clarity

The regulatory landscape for cryptocurrencies is maturing globally. Many jurisdictions are implementing clearer frameworks that provide certainty for businesses and investors while maintaining consumer protections.

The installation of crypto-friendly policymakers in key regulatory positions signals a shift toward more supportive oversight, potentially removing barriers to institutional adoption.

Macroeconomic Factors

Persistent inflation concerns and monetary policy shifts continue to highlight Bitcoin’s value proposition as a hedge against currency debasement. Central bank policies and global economic uncertainty typically drive investors toward alternative assets.

Technological Advancements

Ongoing improvements to Bitcoin’s infrastructure, including Lightning Network adoption and other Layer 2 scaling solutions, are enhancing Bitcoin’s utility for payments and applications. These technological advancements address previous scalability concerns.

Global Adoption Metrics

Global adoption continues to grow, particularly in emerging markets facing currency instability. The number of Bitcoin wallets with non-zero balances has consistently increased, indicating broader retail participation despite market cycles.

Key Insight: The convergence of the post-halving supply reduction, institutional adoption, and regulatory clarity creates a uniquely favorable environment for Bitcoin in 2025. Unlike previous cycles, this bull run may be characterized by more sustainable growth driven by fundamental factors rather than purely speculative interest.

How Investors Can Prepare for the 2025 Bitcoin Bull Run

Strategic Accumulation

Consider dollar-cost averaging (DCA) to accumulate Bitcoin during the current market phase. This strategy reduces the impact of volatility and eliminates the need to time the market perfectly.

Risk Management

Establish clear position sizing and risk parameters before the bull run begins. Determine what percentage of your portfolio you’re comfortable allocating to cryptocurrencies and stick to your plan regardless of market emotions.

Exit Strategy Development

Create a predetermined exit strategy with specific price targets or technical indicators that will trigger partial profit-taking. Having a plan before euphoria sets in helps avoid emotional decision-making at market peaks.

“What tends to drive Bitcoin price actions is sentiment, which technical analysis is designed to address. Sentiment is simply analyzing herd mentality, which manifests in repeatable patterns.”

Important: While historical patterns suggest a significant bull run in 2025, all investments carry risk. Never invest more than you can afford to lose, and consider consulting with a financial advisor before making significant investment decisions.

Prepare Your Strategy for the 2025 Bitcoin Bull Run

Download our free guide with detailed analysis, expert insights, and actionable strategies to position yourself for the next major crypto market cycle.

Technical Analysis Indicators for the 2025 Bitcoin Bull Run

Technical analysis provides valuable insights into potential market movements. Several key indicators are particularly relevant for identifying the early stages of the 2025 Bitcoin bull run:

On-Chain Metrics

On-chain data offers unique insights not available in traditional markets. Key metrics to monitor include:

- HODL Waves – Tracking the age distribution of Bitcoin supply can identify accumulation patterns

- MVRV Ratio – Market Value to Realized Value helps identify when Bitcoin is undervalued or overvalued

- Exchange Reserves – Declining Bitcoin on exchanges typically indicates accumulation and reduced selling pressure

- Miner Position Index – Monitors miner selling behavior, which often changes after halving events

Technical Indicators

Traditional technical analysis tools remain valuable for timing market cycles:

- 200-Week Moving Average – Historically provides support during bear markets and serves as a key level to watch

- Relative Strength Index (RSI) – Helps identify overbought or oversold conditions

- MACD Crossovers – Signal potential trend changes on various timeframes

- Stock-to-Flow Model – Projects potential price ranges based on Bitcoin’s scarcity metrics

Stock-to-Flow model projections for Bitcoin through 2025-2026 cycle

Risks and Considerations for the 2025 Bitcoin Bull Run

Bull Case Factors

- Post-halving supply reduction creating scarcity

- Increasing institutional adoption and infrastructure

- Improving regulatory clarity in major markets

- Growing recognition of Bitcoin as an inflation hedge

- Technical improvements enhancing usability and scaling

Risk Factors

- Potential regulatory crackdowns in key markets

- Macroeconomic uncertainty and recession risks

- Competition from central bank digital currencies

- Technical vulnerabilities or security concerns

- Extreme market volatility and liquidation cascades

While historical patterns suggest a significant bull run in 2025, several factors could alter this trajectory. Regulatory developments remain a wild card, with the potential to either accelerate or hinder adoption. Global economic conditions, particularly central bank policies regarding inflation and interest rates, will significantly impact Bitcoin’s value proposition as a hedge.

“In conclusion, while the narratives around Bitcoin support higher prices, history has shown that investing in Bitcoin without risk management can be painful. Bitcoin tends to do the opposite of what the narratives suggest at major turning points.”

Conclusion: Positioning for the 2025 Bitcoin Bull Run

The convergence of Bitcoin’s halving cycle, institutional adoption, and evolving regulatory landscape creates a compelling case for a significant bull run in 2025. Historical patterns suggest that the period 12-18 months following the April 2024 halving could see substantial price appreciation.

However, successful participation in this cycle requires more than simply buying and holding. Developing a comprehensive strategy that includes accumulation targets, risk management parameters, and a predetermined exit plan will be crucial for navigating the inevitable volatility.

Whether you’re a seasoned Bitcoin investor or considering your first purchase, the potential 2025 Bitcoin bull run represents a significant opportunity. By understanding the underlying drivers, monitoring key indicators, and implementing sound investment practices, you can position yourself to potentially benefit from this next phase of the crypto market cycle.

Don’t Miss the Next Bitcoin Bull Run

Get our comprehensive guide to preparing for the 2025 Bitcoin market cycle. Includes expert analysis, technical indicators to watch, and actionable investment strategies.